The Influence of the Importance of Risk Management on Organizational Governance

The Influence of the Importance of Risk Management on Organizational Governance

Blog Article

Discovering the Importance of Risk Management for Effective Decision-Making Techniques

In the complex globe of organization, Risk Management arises as a vital aspect in the decision-making procedure. The capability to identify potential dangers and chances, and strategize accordingly, can spell the distinction between success and failure.

Understanding the Idea of Risk Management

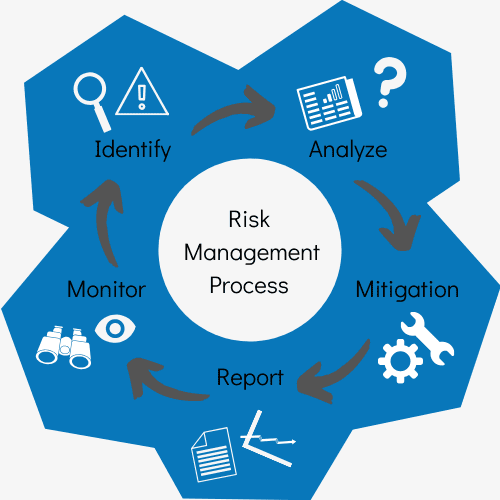

Risk Management, a vital element in decision-making, is frequently misunderstood or oversimplified. Generally, it refers to the recognition, assessment, and prioritization of risks to minimize, keep an eye on, and manage the likelihood or effect of regrettable occasions. It's not simply about preventing adverse outcomes, yet also concerning identifying possible chances. Risk Management involves structured and self-displined approaches, utilizing data and insightful evaluations. It calls for an extensive understanding of the company's context, goals, and the possible threats that could prevent them. From economic uncertainties, lawful obligations, strategic Management errors, to accidents and natural catastrophes, it resolves various dangers. Importantly, efficient Risk Management is not stationary; it's a continuous, progressive procedure that progresses with transforming situations.

The Duty of Risk Management in Decision-Making Processes

In the realm of critical planning and organization operations, Risk Management plays an indispensable role in decision-making processes. Risk Management thus becomes an essential device in decision-making, helping leaders to make enlightened options based on a thorough understanding of the threats involved. Risk Management serves as a vital part in the decision-making procedures of any type of organization.

Just How Risk Management Boosts Strategic Preparation

In the context of calculated planning, Risk Management plays a pivotal function. Initiating with the identification of possible threats, it even more reaches the implementation of Risk mitigation actions. The function of Risk Management is vibrant yet not static, as it demands consistent surveillance and adjusting of techniques.

Determining Prospective Dangers

Implementing Risk Reduction

Risk reduction approaches can vary from Risk evasion, Risk transfer, to risk reduction. Each method should be tailored to the specific Risk, considering its possible effect and the organization's Risk tolerance. Reliable Risk mitigation needs a deep understanding of the Risk landscape and the prospective effect of each Risk.

Tracking and Changing Strategies

Though Risk reduction is a vital step in calculated planning, continual surveillance and change of these methods is similarly crucial. This continuous process allows organizations to determine new dangers and reassess existing ones, ensuring the implemented strategies remain reliable in the ever-changing service setting. It likewise provides a possibility to assess the success of the Risk Management measures, permitting adjustments to be made where necessary, additional improving calculated preparation. Reliable monitoring and modification call for making use of analytics and crucial performance indications (KPIs) to gauge effectiveness. These devices supply useful data-driven insights that can notify tactical decision-making. As a result, tracking and readjusting Risk Management methods is an essential element for enhancing a company's durability and calculated planning.

Case Researches: Successful Risk Management and Decision-Making

On the planet of service and money, effective Risk Management and decision-making typically function as the pillars of thriving business. One such entity is an international oil business that alleviated monetary loss by hedging versus changing oil costs. In another circumstances, a technology startup thrived by identifying and approving high-risk, high-reward techniques in an unpredictable market. An international bank, confronted with regulative uncertainties, efficiently browsed the circumstance through positive Risk evaluation and vibrant decision-making. These situations highlight the worth of astute Risk Management in decision-making processes. It is not the absence of Risk, yet the Management of it, that frequently distinguishes effective business from not successful ones. These cases emphasize the crucial duty of Risk Management in calculated decision-making. importance of risk management.

Devices and Methods for Reliable Risk Management

Browsing the complex puzzle of Risk Management calls for the best set of methods and devices. These devices, such as Risk signs up and warmth maps, help in determining and analyzing possible dangers. Methods consist of both quantitative approaches, like sensitivity analysis, and qualitative methods, such as SWOT evaluation. These aid in focusing on risks based upon their possible influence and probability. Risk feedback strategies, an essential component of Risk Management, include accepting, avoiding, moving, or mitigating dangers. Tracking and managing risks, via normal audits and testimonials, make sure that the techniques remain effective. With these techniques and tools, decision-makers can navigate the complex landscape of Risk Management, thereby promoting notified and effective decision-making.

Future Fads in Risk Management and Decision-Making Approaches

As we discover the large landscape of Risk Management, it becomes obvious that the tools and methods utilized today will certainly continue to develop. Future patterns direct towards a raised reliance on modern technology, with expert system and artificial intelligence playing substantial roles. These innovations will allow imp source organizations to anticipate possible risks with higher accuracy and make even more informed decisions. In addition, there will certainly be an expanding emphasis on resilience, not simply in handling threats yet also in bouncing back from unfavorable circumstances. The idea of Risk society, where every participant of a company is mindful and entailed in Risk Management, will acquire a lot more prominence. These trends declare a more aggressive and comprehensive approach towards Risk Management and decision-making.

Conclusion

Risk Management therefore becomes a vital device in decision-making, aiding leaders to make informed read what he said choices based on a comprehensive understanding of the threats entailed. Risk mitigation techniques can range from Risk evasion, Risk transfer, to risk decrease (importance of risk management). Efficient Risk mitigation calls for a deep understanding of the Risk landscape and the prospective impact of each Risk. Risk action techniques, a key part of Risk Management, include accepting, avoiding, moving, or mitigating threats. The idea of Risk culture, where every member of a company is mindful and included in Risk Management, will gain extra importance

Report this page